Crypto Token Supported With Real Assets

With infrastructure investors Swarm can create and operate asset backed tokens and participate in a wealth creation mix.

Swarm is The Bridge

Swarm Fund connects crypto market with real assets and old world finance.

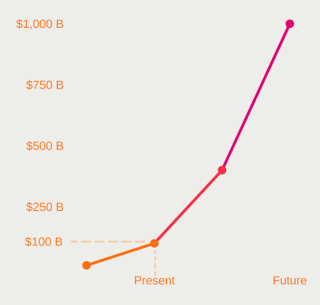

Exponential Market Growth

Our Value Proposition

The Crypto market has reached $ 100B on the underlying technology platform potential. But what will bring this market to more than $ 1 trillion is the introduction of assets and real partners of the existing financial industry. Swarm has partners and teams to generate this $ 1 trillion potential.

Market Problems in Traditional Investing

Over the last 15 years, a simple S&P 500 index fund outperformed 92% of large-cap funds . Even higher, the percentages of mid-cap and small-cap funds lagging their benchmarks were 95% and 93%, respectively. The odds of doing better than an index fund are near to 1 out of 20 when selecting an actively-managed domestic equity mutual fund.

Finding products with high investment return is a challenge, which increases as the target return increases. The marquee products offering more than 10% returns are invariably hard to access (Bridgewater generally requires that its clients have a minimum of $5 billion of investable assets)

Take real estate as an example. Investors mostly face three major challenges :

Large amounts of money is required to participate in the best opportunities.

Worst of all, investment is often tied down for an indefinite amount of time.

Combinations of these challenges are part of any traditional investment product category, e.g private equity and hedge funds.

Mission Statement :

Why We Created SWARM FUND

Swarm is a fully decentralized capital marketplace platform built on blockchain technology that is entirely owned by the community.

Our vision is to allow anyone, anywhere in the world, to participate in the value creation within the crypto asset category and to capture opportunity in new types of asset-backed tokens, anything from distressed real estate to solar installations to rainforest preservation projects and many more.

Swarm turns financial opportunities from exclusive into inclusive. We provide the empowerment, access, and tradability so anyone can take part and have their crypto funds work for them.

With Swarm we will :

Make it extremely simple for hands-off, or novice crypto investors to participate in a composite of wealth creation resulting from utilizing the crypto space.

Create a viable framework and hub for crypto investors to invest into alternative, asset-backed token opportunities, in order to escape market volatility.

Introduce a new alternative liquidity hub for project owners with attractive underlying economics to find capital and engage with the investor community.

Core Objective: Follow The Experts

We are building an ecosystem of experts with any kind of edge (track record, trading ability, unique data, unique deal access, etc.) to allow crypto investors to follow and co-invest with them.

This changes the mechanics of the traditional fund/GP model, as investments can be as large or small as the investor wants them to be, and they can operate the fund structures very flexibly. Also, it breaks up the syndicates of gatekeepers and rigid structures of institutional capital as it is deployed today.

Core Objective: Combine Token Flexibility With Real Opportunities

When a participant likes an opportunity running on Swarm they will be able to pool funds together with others and invest as little or as much as they want to realize the project and see the opportunity grow.

At the same time, all the projects become tradable asset-backed tokens. Participants can buy or sell these tokens whenever they want, and they decide how long to engage. All trades are made using blockchain technology, making them fast, transparent and secure.

Core Objective: Collective Intelligence

The foundational element of the blockchain is data transparency, which provides a basis for an unprecedented degree of machine-driven methods to generate insights and take actions.

Ultimately, with Swarm we envision a degree of investment automation, that helps participants make informed and data-driven investment decisions, while using reputational scores to maintain the health of the market. But automation goes further, where every step of the investment process, from workflows to set-up of legal structures can and will be automated over time, creating an efficient system without single points of failure or control

With Swarm we envision a degree of investment automation.

Swarm Token

The utility unlocked by the SWARM token is the ability to create subfunds, participate in token offerings of Swarm projects, get access to information that is exclusive to our network, and execute network governance functions. Participation of its members is key to the Swarm platform. Over time, more functionality will be released that helps generate swarm intelligence for the benefit of the network. This follows the model pioneered by Visa, SWIFT, and other consortia where common infrastructure is maintained by member organizations.

Two-Tiered Token Model

The second layer includes the many financial opportunities run by the Swarm syndication partners and made possible through their own applications and tokens on the SUN (Swarm Utility Network).

The use of Swarm Services and Application layers happens on the Swarm Utility Network (SUN). Participants of SUN will be charged fees, similar to those of a trading market (SUN Fees). These fees will initially be denominated in cryptocurrency, namely ETH or BTC, but later also in SWARM tokens.

SUN tokens can be custom to each project. Once the Swarm network clears way for a new application to be established, participants of SUN can release their own tokens (SUN Tokens) for their application, against which they can raise their own application liquidity, ultimately in both crypto and fiat funds.

SUN tokens can evolve into different versions based on newer features or governance structures. SUN tokens can abide by their own governance and regulations, subject to oversight by the Swarm community.

Token Me Chanism

The SWARM tokens are created for the network to govern a market infrastructure for a much larger pool of assets running on the Swarm Utility Network. The initial supply of SWARM tokens is dimensioned for an asset pool of $5B in value.

As the capital deployed into the Swarm Utility Network surpasses the threshold value of $5B, the Swarm foundation can issue tokens at a fixed rate (3.5%) relative to the amount of capital raised. For example, $100mm of fiat will authorize the creation of 3.5mm new tokens. The rate (but not the threshold value) may be adjusted periodically by Swarm’s governing bodies. The Swarm foundation may use this for sustainable future financing and development budget.

At launch, Swarm will already have the full governance model for the network operating. Additional bylaws of the Swarm organization are expected to follow the DCO model established at the Stanford legal summit with some modifications to be decided upon by our legal advisors. A foundation representing this model will be established after the contribution period is complete. This will happen via an incentivized bounty provided to the first legal team who is able to implement the foundation model with the appropriate integrations.

Swarm Platform Model

The Swarm platform will be composed of three primary layers: Core, Services, and Application.

The Core layer provides the foundational system components and smart contracts for Swarm use: network governance token management with consensus via liquid democracy, and a management interface. This also includes system replications of the preferred legal frameworks, reputational engine, decentralized collaboration, as well as foundational processes around security & data transparency. The Core layer’s framework allows for the creation and management of new projects. It is and always will be free and open to use.

Layer 2: Swarm Services The Swarm Services layer will offer additional

services on top of Swarm Core. These services are meant to make it extremely easy for any participants to build investment applications on top of Swarm and serve the marketplace in the most creative way. These services will include full-stack setup of vertical Swarm funds (via Special Purpose Vehicles, or SPVs), operating swarm syndicates, asset custodian services, and any automation of ongoing investment operations. More features will be introduced to best meet the requirements of the evolving marketplace. Application templates, customization tools, and advanced data processing capabilities will allow our users to execute their visions faster while lowering the barrier to entry for new investment applications to come to market. While applications and participants are welcome to interact with Swarm on the Core level, we will be offering Swarm Services to accelerate their go-to-market process and reduce operational costs. Swarm Services will be offered using a license-fee model.

Layer 3: Swarm Applications On the highest layer, on top of the Swarm

Services layer or directly operating on the Swarm Core, is the Swarm Applications layer. These applications are both front-end as well as in some cases application back-ends that are specific to target investment use cases and/or target segments.

Our vision for Swarm is to have a wide variety of investment applications built on the same platform technology and liquidity pool.

Some of these applications may be built by Swarm, while others will be built by third parties. Our vision for Swarm is to have a wide variety of investment applications built on the same platform technology and liquidity pool. These applications will likely charge additional fees or use alternative business models such as market making, information selling, or revenue/profit sharing. As further described in the following section, many of such Swarm applications may include the release of their own utility tokens as a core component of their business model.

Basic Structure Of Swarm

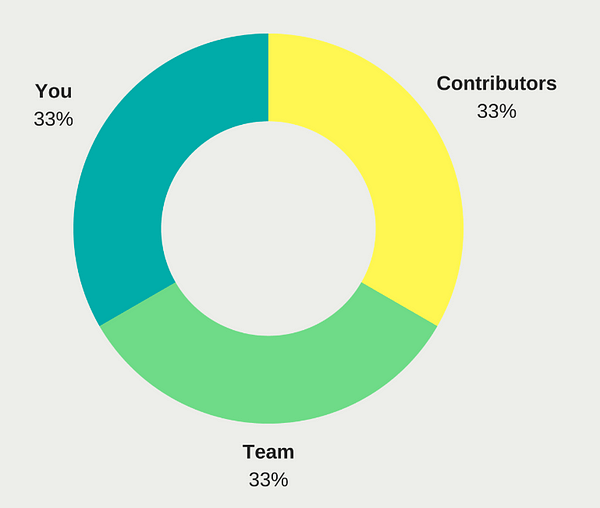

Swarm Token Distribution

We Share The Pie

Swarm has been a community from the very beginning, with a $1 million token sale that set in motion a whole new legal and governmental framework. Today those past contributors are joined by a new team that have pledged to take this from $1 million to $1 trillion worth of value. Every area of contribution is awarded equally.

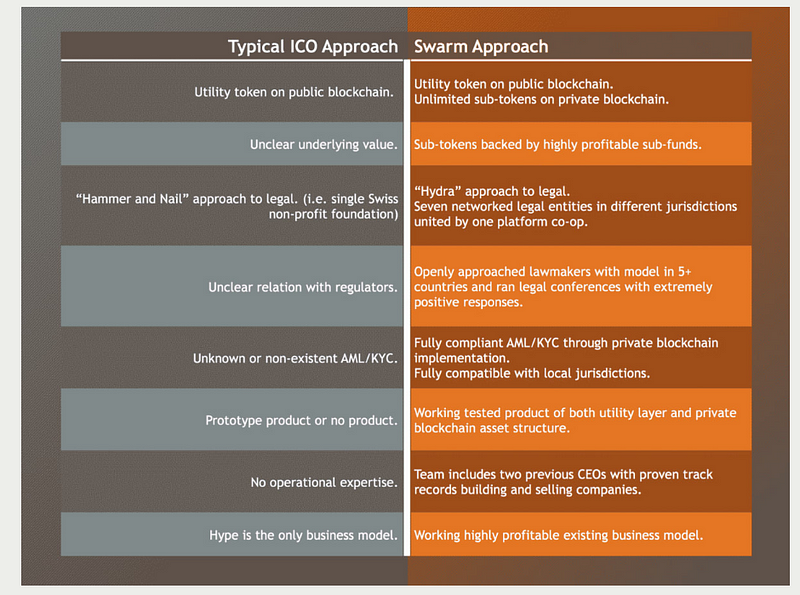

Swarm is Better

GOOD Team

Website: https://www.swarm.fund/

Whitepaper : http://sites.swarm.fund/whitepapers/Cooperative-Ownership-Platform-for-Real-Assets.pdf

Slack : https://join.slack.com/t/swarmnetworkgroup/shared_invite/MjIzOTM2OTg5OTU3LTE1MDIyMTA5MDAtNzlmNjVkNWMyOA

Lightpaper : http://lightpaper.swarm.fund/

Bitcointalk (ryanencek) : https://bitcointalk.org/index.php?action=profile;u=1076774

My ETH : 0xaE5e525E57a6117fa00Ae27b57e94b92B1Bf0c51

Tidak ada komentar:

Posting Komentar